yvonnebodenwie

About yvonnebodenwie

Greatest Loans for People With Bad Credit: A Comprehensive Information

Navigating the world of loans will be particularly challenging for individuals with bad credit. A low credit score rating can limit choices and result in greater interest charges, making it essential to understand one of the best out there loan choices. This article explores various kinds of loans out there for individuals with unhealthy credit, the factors to think about when applying, and ideas for improving monetary health.

Understanding Unhealthy Credit

Earlier than diving into loan choices, it is essential to define what constitutes dangerous credit score. Generally, a credit score beneath 580 is taken into account poor. This score can end result from missed funds, excessive credit utilization, or different monetary missteps. Lenders view individuals with unhealthy credit as larger-risk borrowers, which may result in limited loan decisions and increased prices.

Kinds of Loans for People with Bad Credit

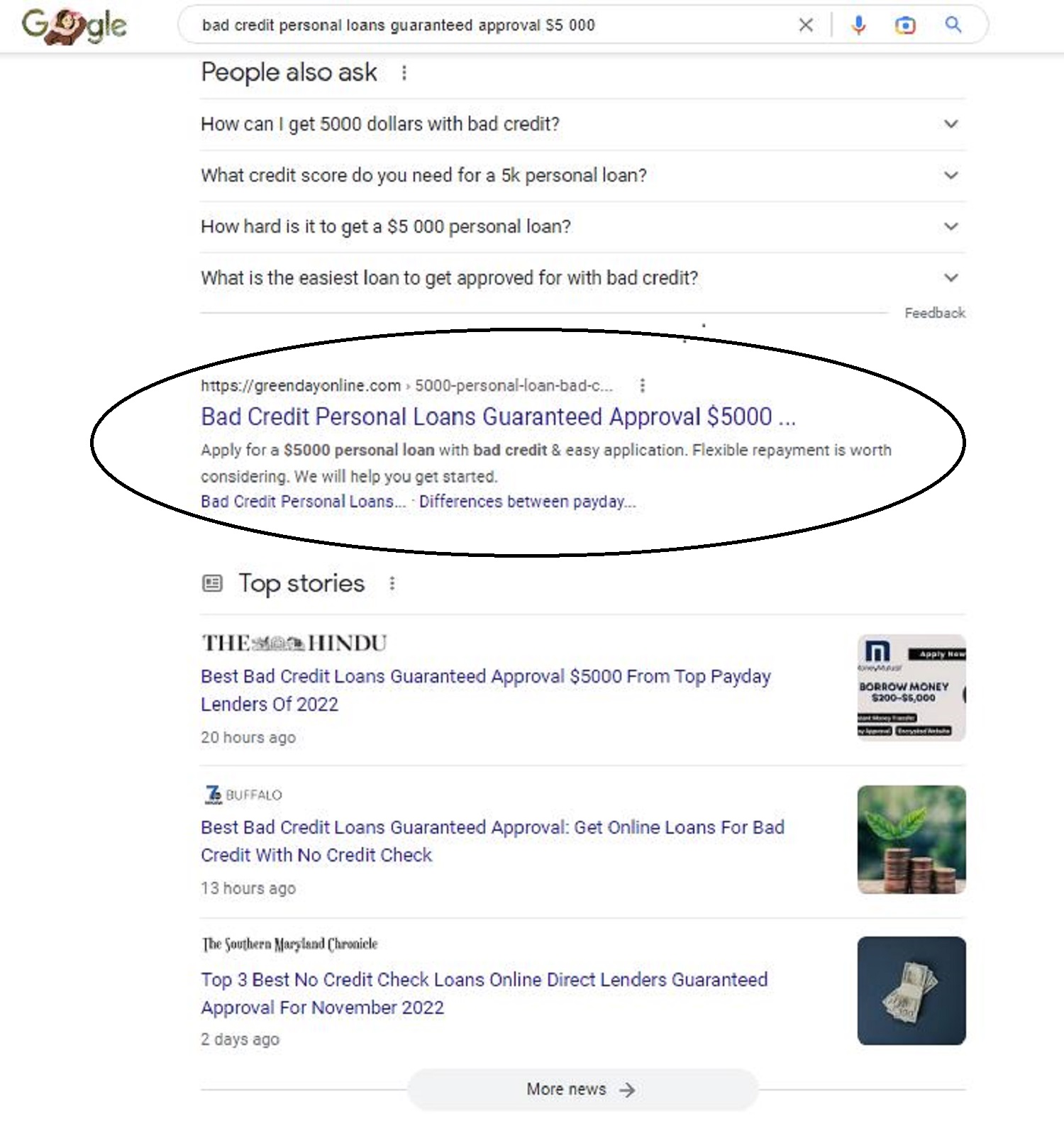

- Personal Loans

Personal loans are unsecured loans that can be used for varied functions, including debt consolidation, house improvement, or unexpected bills. Whereas traditional banks may be hesitant to lend to these with bad credit score, many on-line lenders specialise in providing personal loans to high-danger borrowers. These loans typically come with higher curiosity rates, but they can present fast access to cash.

- Secured Loans

Secured loans require collateral, comparable to a automotive or savings account, which reduces the lender’s risk. As a result of the borrower gives security, secured loans could have decrease curiosity charges compared to unsecured loans. Nevertheless, the downside is that if the borrower defaults, the lender can seize the collateral.

- Payday Loans

Payday loans are short-term, excessive-interest loans designed to cover bills till the following paycheck. Whereas they’re easy to acquire, they come with exorbitant interest charges and fees, often leading to a cycle of debt. Borrowers ought to approach payday loans with caution and consider them a last resort.

- Credit Union Loans

Credit unions typically have extra versatile lending standards than traditional banks. They’re member-owned and may offer lower curiosity rates and charges. Individuals with unhealthy credit score can benefit from establishing a relationship with an area credit union, as they may present personal loans tailored to their financial state of affairs.

- Peer-to-Peer (P2P) Loans

P2P lending platforms connect borrowers with particular person traders willing to lend money. These platforms typically consider factors beyond credit scores, such as earnings and employment history. Whereas interest rates can range, P2P loans might provide extra favorable terms for those with dangerous credit score.

- Title Loans

Title loans allow borrowers to use their automobile’s title as collateral for a loan. These loans could be obtained shortly, but they often include excessive-interest rates. Much like secured loans, failure to repay can outcome within the lack of the car.

Components to contemplate When Making use of for Loans

When seeking a loan with dangerous credit, borrowers should consider a number of key elements:

- Interest Rates: Evaluate curiosity charges across different lenders. Even a small difference can significantly impression the overall repayment quantity.

- Loan Terms: Understand the loan duration and repayment schedule. Shorter phrases may have greater monthly funds however lower overall interest prices.

- Fees: Remember of any origination charges, late payment penalties, or other prices associated with the loan. If you adored this article and you also would like to collect more info pertaining to personalloans-badcredit.com please visit our internet site. Hidden charges can add to the general expense.

- Lender Fame: Analysis lenders completely. Look for opinions and rankings from previous borrowers to make sure the lender is reliable and transparent.

- Prequalification Options: Many lenders supply prequalification, permitting borrowers to see potential loan gives without affecting their credit score. This can help make knowledgeable choices.

Tips for Enhancing Credit Scores

Whereas securing a loan with bad credit score is feasible, improving one’s credit score can open up extra favorable lending choices in the future. Here are some methods to think about:

- Pay Payments on Time: Constantly making payments on time is one in every of the most effective methods to boost a credit score. Organising computerized payments or reminders can assist.

- Reduce Credit score Utilization: Aim to maintain credit card balances below 30% of the out there restrict. Paying down existing debt can improve credit score utilization ratios.

- Examine Credit score Studies: Repeatedly assessment credit score studies for errors or inaccuracies. Disputing incorrect data will help enhance the score.

- Limit New Credit Purposes: Every credit score inquiry can temporarily decrease a credit score score. Borrowers should limit new functions and deal with bettering existing credit accounts.

- Consider a Secured Bank card: Secured credit cards require a money deposit that serves as collateral. Responsible use may help rebuild credit score over time.

Conclusion

Securing a loan with dangerous credit will be daunting, but numerous choices are available for these in need. Personal loans, secured loans, credit union loans, and P2P lending can provide financial relief, albeit typically at a better price. It is crucial for borrowers to totally analysis their options, understand the phrases, and work in the direction of improving their credit score scores for higher opportunities in the future. By taking proactive steps and making informed decisions, individuals with bad credit score can navigate the lending landscape extra successfully and work towards attaining their monetary targets.

No listing found.